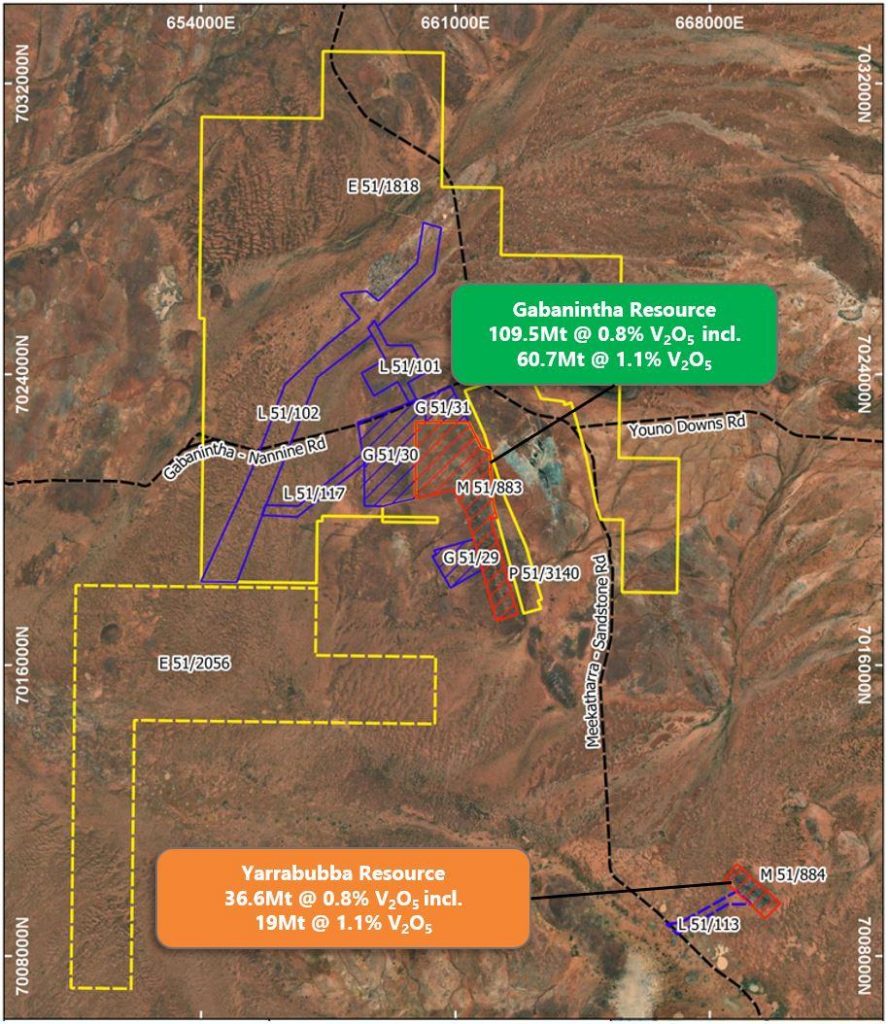

The MTMP is one of the most advanced undeveloped vanadium projects in the world. Several studies have been completed including a Definitive Feasibility Study on Gabanintha in 2019 and the Yarrabubba Integration Study completed in mid-2022.

The MTMP Integration Study finalised in 2022 has merged the satellite deposit Yarrabubba into the mine schedule, extending the MTMP mine life out from 16 to 25 years. The updated Yarrabubba ore reserve estimate represents a 69% increase on the previous ore reserve estimate, with the addition of the maiden ilmenite (TiO2) ore reserve at Yarrabubba generating 1.13 Mt of ilmenite product over the life of mine.

The Integration Study continues to indicate that the MTMP will be the largest primary producer of vanadium in the world.

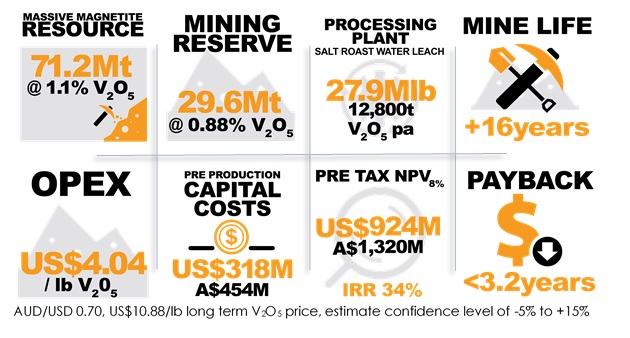

Technology Metals delivered the findings of its Definitive Feasibility Study (DFS) in August 2019.

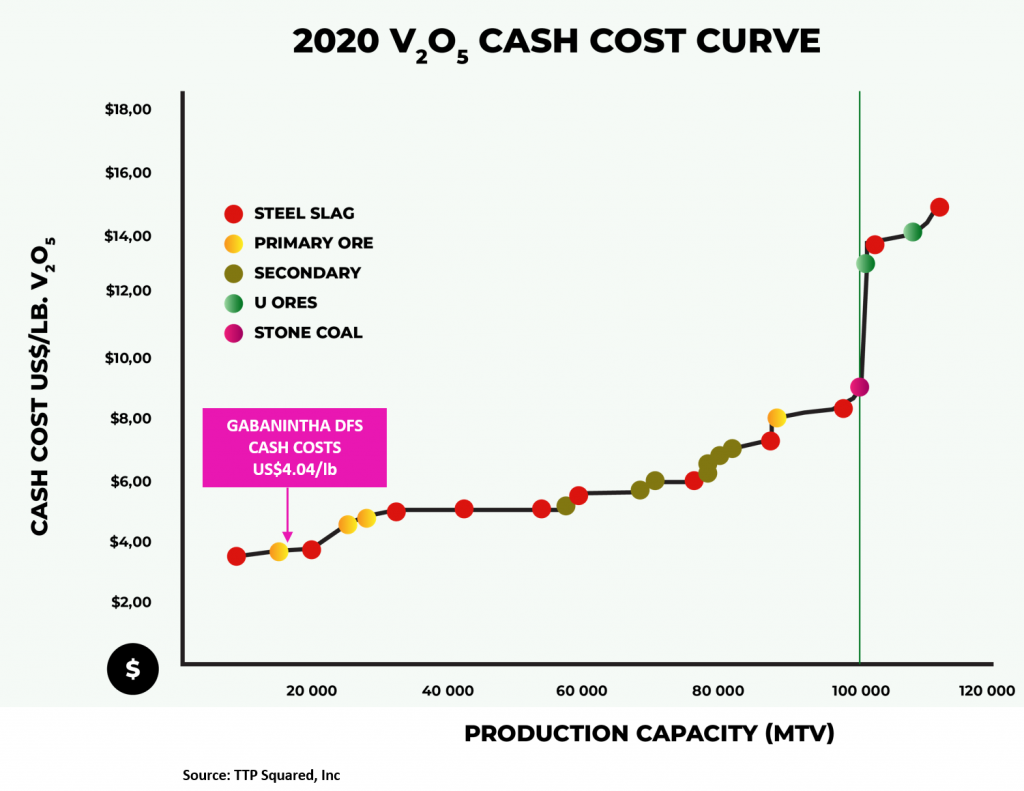

The DFS shows the Gabanintha project is one of the most attractive undeveloped vanadium projects globally. Key findings of the study demonstrated that Gabanintha is a large, long-life project that will command lowest quartile costs of operation.

A Mining Reserve of 29.6Mt @ 0.88% V2O5 and targeted average production rate of 27.9 Mlb per annum V2O5will make TMT the largest primary vanadium producer in the world.

Since completion of the DFS the mining leases have been granted, mineral resources / mining reserves have increased and the ERD submitted.

| Key Metric | Unit | DFS |

|---|---|---|

| Long Term Vanadium Price Forecast1 | US$/lb V2O5 | 10.88 |

| Exchange Rate Assumption | A$: US$ | 0.7 |

| Total Revenue | A$m | 7,109 |

| Total EBITDA | A$m | 4,063 |

| Average Annual EBITDA (Steady State) | A$m | 268 |

| Total Pre-Production Process Plant Capex3 | A$m | 454 |

| Total Stage 2 / Deferred Capex3 | A$m | 64 |

| Total Operating Expenditure | A$m | 2,957 |

| Average Operating Costs | US$/lb V2O5 | 4.04 |

| Average All in Sustaining Costs | US$/lb V2O5 | 5.75 |

| Discount Rate Assumption | % | 8 |

| Net Present Value 8% (pre-tax) | A$m | 1,320 |

| Internal Rate of Return (pre-tax) | % | 34.2 |

| Net Present Value 8% (post-tax) | A$m | 870 |

| Internal Rate of Return (post-tax) | % | 27.3 |

| Anticipated Payback on Capital | Years | 3.2 |

1 – US$10.59/lb V2O5 from 2028

2 – Includes A$49.5m contingency, A$64.9m RPCM, $13.9m owners and indirect costs. Does include $16.0m mining pre-production capital.

3 – includes crystallisation and ion exchange plants to reduce reagent (salt) consumption and increase recovery.

1 – Historical 15 year mean vanadium pentoxide price from April 2004 to March 2019 (source: TTP Squared)

2 – PFS pricing averages US$12.82 over the operating life (as per ASX release 21 June 2018)

| V2O5 Pricing Scenarios | Unit | Flat1 US$8.78/lb | DFS US$10.88/lb | PFS2 US$12.82/lb |

|---|---|---|---|---|

| Total Revenue | A$m | 5,665 | 7,019 | 8,270 |

| Total EBITDA | A$m | 2,776 | 4,063 | 5,250 |

| NPV8% After Tax | A$m | 409 | 870 | 1,246 |

| IRR After Tax | A$m | 17.1 | 27.3 | 32.4 |

| NPV8% Before Tax | % | 663 | 1,320 | 1,860 |

| IRR Before Tax | % | 21.0 | 34.2 | 40.2 |

| Free Cash | Year 1-6 | 629 | 1,044 | 1,347 |

As part of the comprehensive DFS testwork conducted by leading kiln expert FLSmidth in the USA confirmed the operating parameters and scalability of the processing method. This work represents some of the most successful and comprehensive testwork completed on an undeveloped vanadium project.